- 12 Mar 2024

- Print

- DarkLight

- PDF

Updating Your Tax Form

- Updated on 12 Mar 2024

- Print

- DarkLight

- PDF

If you need to make adjustments to your tax form (W-9 or W-8BEN), such as change your address or update your taxpayer identification number (TIN), then you'll need to complete a new tax form. Submitting a new tax form will take precedent over your previously submitted form. You can refer to our help articles to make sure you're filling out the right tax form:

If you receive an email notifying you that your tax form was invalid, you will have up to 30 days to update your forms again. If you don't, then the IRS will apply backup tax withholdings on your payments due to incorrect information appearing on your tax form. See the IRS' article on Backup Withholding and this article's section Why is my tax form considered invalid? for more information.

How to do it

Updating a tax form

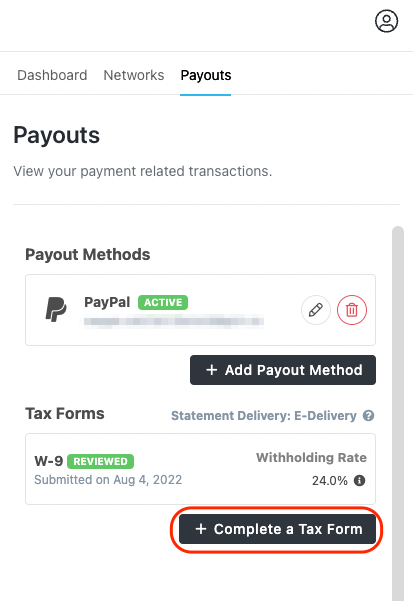

- Navigate to your Live Site > Payouts.

- Select Complete a Tax Form.

- Select either I am aU.S. Person or I am not a U.S. Person, then follow the steps to complete your appropriate tax form. You can review our help guides for more details:

If your address was considered invalid, you'll need to make sure the new address you submit matches in the following places:

- The tax form itself

- The Payout Method, which can either be on your Live Site > Payouts or at https://grin.portal.trolley.com/.

- If you chose I am a U.S. Person: See Setting up payouts as a U.S. resident

- If you chose I am not a U.S. Person: See Setting up Payouts as a non-U.S. resident

Your tax form has been updated with your most recent information.

Why is my tax form considered invalid?

The IRS validates the information you provide in your tax form with what it has on file for you, including your name, address, and taxpayer identification number (TIN). The IRS verifies this information themselves and lets GRIN know if they found it valid or not.

If your tax form is considered invalid, you may be subject to a 24% backup tax withholding as a U.S. resident or a 30% backup tax withholding as a non-U.S. resident. GRIN will send you an email if the IRS finds that you submitted an invalid tax form. Once you receive that email, you have 30 days to update your tax forms so you are no longer subject to any backup tax withholdings. Here are a few common reasons why your tax form may have come back as invalid:

- You submitted the wrong Taxpayer Identification Number (TIN). The first thing to check is to make sure you submitted the right TIN. A TIN can be a number of different identification numbers that are unique to your situation. You can learn about what is considered a TIN with the IRS’ help article.

- You filed under the wrong classification. If, for example, you filed as an LLC but did not provide the correct business name or TIN for that LLC, then your tax form will be considered invalid.

- You used the wrong name. If you used a nickname or a shortened version of your name instead of your legal name or whatever name the IRS has on file when filling out the form, then your tax form will come back as invalid even if you provided a correct TIN.

- You provided the wrong address. If you entered your address incorrectly, or if you provided an address that doesn't match up with your reported residence (for example, you identified yourself as a U.S. resident on your tax form, but then provided an address based outside of the U.S.), then your tax form will be considered invalid.

Because all this information is sensitive, we can’t access any of this information that the IRS has (such as your business or personal address, your TIN, your legal name, and more). The IRS only tells us if they found the tax form invalid or not. Unfortunately, GRIN won’t be able to tell what the exact source of the conflict was in your tax form.

If you’re confident that you submitted all the correct information and your tax form is still coming back as invalid, then consult with the IRS or a tax professional to cross-reference your information. GRIN is not able to provide tax advice at this time. You can also try the following resources from the IRS to find out your taxpayer information: