- 21 Feb 2024

- Print

- DarkLight

- PDF

Setting Up Payouts as a Non-U.S. Resident

- Updated on 21 Feb 2024

- Print

- DarkLight

- PDF

In order to receive payouts from the brands you work with, you need to submit your Payout information on your Live Site. This includes:

- Your payout method, which must be a PayPal account

- If your brand is paying you through GRIN, a valid tax form, which is a W-8BEN for non-U.S. residents (if you're based in the U.S., see Setting up payouts as a U.S. resident). For more information on W-8BENs, check out this article from the U.S.’ Internal Revenue Service (IRS).

A W-8BEN is considered valid if all the information you provide, such as your name, address, and taxpayer identification number (such as an SSN or an FTIN), matches whatever is on file for you at the IRS or relevant tax agency where you originally created your tax information. If any of the information comes back as incorrect, GRIN will send you an email notifying you that your tax form is invalid. If that happens, you will have 30 days from when you receive the email to correct your information, otherwise you may be subject to backup tax withholdings by the IRS on your earnings. See Yearly income tax forms FAQ for more information on why your tax form may be invalid.

You’ll need to have a PayPal account already set up before adding it as a payout method, but you can complete a W-8BEN directly through your Live Site. Once you set up both of these items, you’ll be able to receive payments from the brands you work with. You’ll also receive 1042 tax forms at the beginning of each year, which will cover your payouts from the previous calendar year. For more on 1042s, see our article Yearly income tax forms FAQ.

If you don't connect your PayPal account on your Live Site and submit a tax form, any payments your brand makes to you through GRIN will be refunded within 30 days. Be sure to set up your payout information as soon as possible so you can start receiving payouts for your collaborations with brands!

What you'll need

- A verified Live Site account. To learn more, see Verifying your account.

- An existing PayPal account. Your payments will be sent to that PayPal account. Currently, you can only receive payments through PayPal.

How to do it

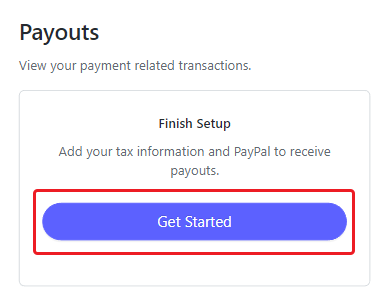

- Navigate to your Live Site > Payouts.

- Select Get Started under Finish Setup.

- Select your country. This should be the country that you file your taxes in. Then, select Set up Tax Information.

- On the "You're almost finished!" screen, select Continue.

- Select + Add Payout Method.

.png)

- Fill in your General Information, then select Next at the bottom of the page.

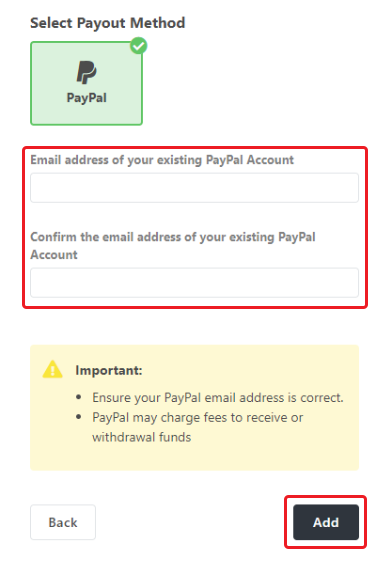

- Enter and confirm your PayPal email address. This address should be the one you use with your preferred PayPal account. Then select Add.

- Select Submit a Tax Form.

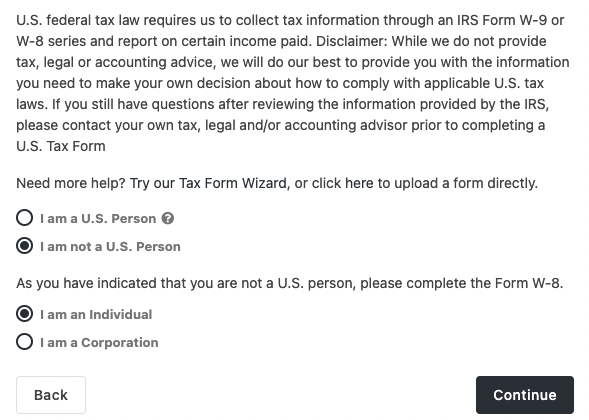

- Select I am not a U.S. Person and I am an individual or I am a Corporation, then select Continue.

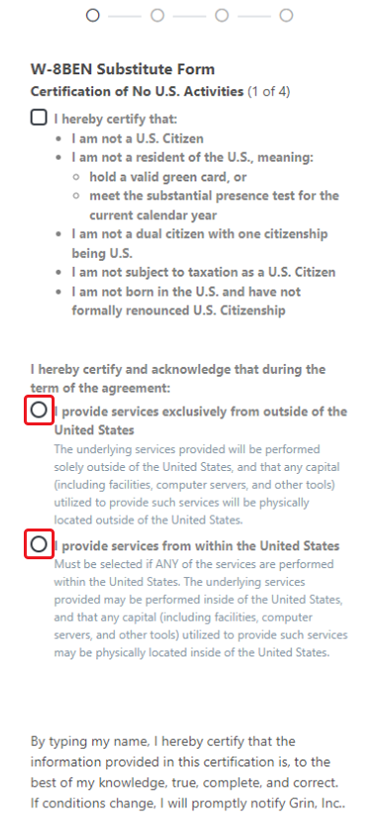

- Select the checkbox to certify you are not a U.S. person, then select either I provide services exclusively from outside of the United States or I provide services from within the United States.

- Enter your full name to certify the information you provided, then select Certify.

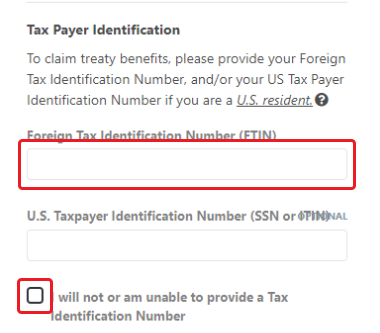

- Fill in all fields for the W-8BEN Substitute Form and select Continue.

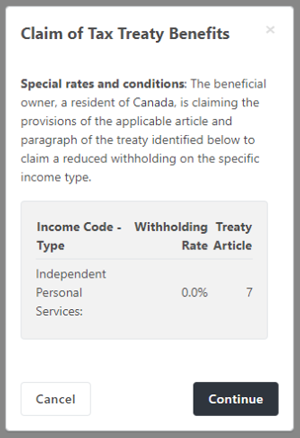

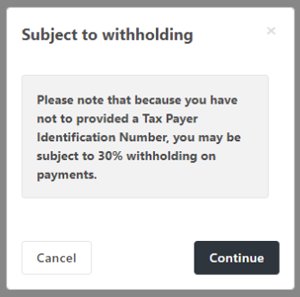

- Review the popup that appears and select Continue. Depending on how you filled in your Tax Payer Identification section, this popup will be different:

- If you provided a Foreign Tax Identification Number (FTIN), you’ll be informed about any possible withholding rates you may be subject to depending on your country of citizenship. If you do not use a valid FTIN, you may be subject to tax withholdings from the IRS.

- If you selected “I will not or am unable to provide a Tax Identification Number”, you’ll be informed that you may be subject to 30% withholding on your payments.

- Review your W-8BEN information to ensure everything is correct, then select Continue.

- Select all the checkboxes to certify the information you’ve provided, then check the box to confirm you've read and acknowledged the certification.

- Enter your full name, then select Complete W-8BEN. This will open the Submitting W-8BEN popup.

- Select Submit Form to submit your W-8BEN.

- Choose how you'd like to receive your tax statements:

- E-Delivery: Your tax statements will be emailed to you at the address provided in your Live Site > Settings.

- Postal Mail: Your tax statements will be mailed to you at the address provided in your Live Site > Settings.

- Select Continue at the bottom of the page.

That’s it! Your completed tax form should now appear underneath your payout methods along with your PayPal account, as shown below. Now, you’re ready to receive payout from brands you collaborate with!